#FundedFounders: In conversation with ServiceMarket

SME10X in conversation with Bana Shomali and Wim Torfs, Founders of ServiceMarket. Here are excerpts from the chat...

How did you secure this funding and what were the stages in the process?

We secured our latest funding of USD 4m from AddVenture and Emaar Industries & Investments (Pvt.) JSC. The process through which a start-up fundraises is fluid and takes quite some time - but tends to follow three stages, starting off with a general pitch to the investors, and if they’re interested in taking the conversation further, a number of working sessions to go through the numbers and plans in detail, followed by a due diligence conducted by a professional firm hired by the investors, followed by their final decision to invest and on what terms.

What were the key considerations that went into plotting your funding strategy?

The first step in building our funding strategy was to have a clear understanding of our growth strategy. That means developing a clear plan on how and where we planned to grow, and what funding was required to achieve those growth milestones. Calculating how much investment is required is critical, because raising too little will cripple your growth, and raising too much dilutes your share in the company unnecessarily. Once we defined our funding requirements, we reached out to a diverse net of investors who we thought could be interested in a home services aggregator like ServiceMarket. We started the process nine months earlier, given that such large fundraises take time.

What do you plan to use the funding for?

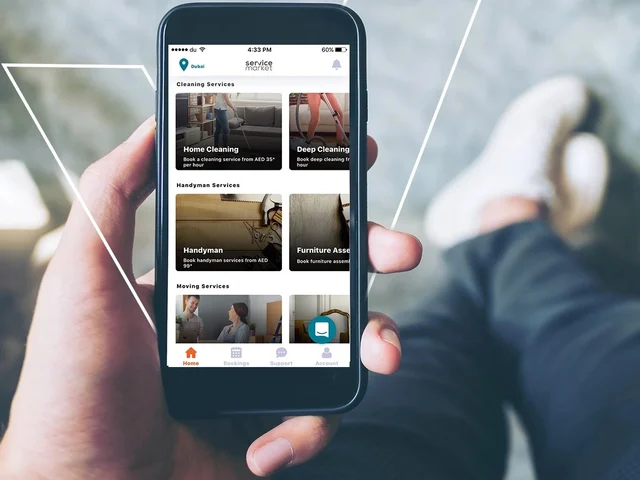

We will use this investment in a number of ways. First, it will allow us to offer an even wider range of services to our customers, further establishing ServiceMarket as a one-stop shop for any home service. We will also be investing in our customer experience to ensure we retain our competitive edge in that area. We will also continue to build out our technology platform to make sure that the transaction between customer and service provider is faster and more seamless.

With this level of funding, do you have a structured plan for the company's expansion?

Of course. As part of your fundraising activity, you need to have a concrete plan and understanding of how you plan to grow the company. The expansion plan is the basis of the fundraise.

We have been following ServiceMarket’s traction within Dubai and they have received positive feedback from users on its ease of use, speed and convenience. This investment makes strategic sense for EII under our technology platform, since ServiceMarket offers services that complement our ecosystem.Waleed Dhaduk, the Acting CEO & CIO of Emaar Industries Investments

How do you see ServiceMarket progressing towards larger levels of investment should you be looking to expand further in the future? Is that on the cards?

We have fundraised in the past when we needed to make significant investments to push our company onto a faster growth trajectory. We continuously re-invest company profits within the company, but that only allows you to grow at a certain rate. If you want to grow faster, you will need external funding.Looking ahead, we will use that same philosophy in our fundraising strategy. If we can fund our investments on our own, we will obviously prioritize that, but if we see an opportunity in the market that we want to capture, we will look to find investors who share the vision and want to invest in the idea with us.

As a business owner, how do you manage to balance the breathless pace of fundraising and running your company?

I’m lucky that I am not alone in my journey. My co-founder Wim Torfs and I share the responsibility of building the company and fundraising. We have also built a great team of enthusiastic and hardworking professionals within ServiceMarket, who help drive the day-to-day business. While we are usually in the driving seat of the fundraising activity, it takes an entire team to keep the company successful and growing.

How does the dynamic of a company change when you have a diverse set of investors on board?

The day-to-day for us did not change dramatically - in fact, our investors want us to focus on building the business and hitting our growth targets. So we have been lucky that our investors have that philosophy. Of course, when you onboard a group of external investors, you need to start introducing some more formal communication and decision making processes, such as formal board meetings, periodic reports, etc., to keep your shareholders and investors engaged and informed.

Do you agree that the first round of funding is the hardest part and then other investors start looking at you more closely?

Every fundraise has its own dynamics and challenges. Obviously, the first can be seen as the hardest, because up until that point, you’ve funded the business on your own, and investors don’t know you or your company yet. Our Series A and Series B investment rounds had their own unique dynamics also, because we were raising significantly larger amounts every time, so the challenge there is to prove that you can scale your business effectively and achieve your growth targets.

Finally, what is a piece of advice you have for business owners looking for funding/investment?

Start early. Fundraising is at least a six month process, and you’ll get a lot of feedback along the way as you pitch to several investors. Second, diversify your investor pool. We reached out to angel networks, VCs, and traditional corporates, besides local and international VC firms. As a result, our latest round included Addventure, a venture capital firm, and Emaar Industries & Investment. Finally, I would say, have patience and don’t lose hope. As you pitch your company to several people, you will get a lot of feedback and criticism. Incorporate what you think is helpful, and keep moving forward. You’ll eventually find investors that share your vision and want to join you on your journey.