Payment Solutions Signal Positive Momentum for MENA Fintech

MAGNiTT’s Q3 2023 MENA FinTech Venture Investment Report shows that FinTech saw a 47 percent retreat in capital raised when compared to the same period in 2022. While Q3 witnessed a 10 percent quarter-on-quarter (QoQ) decrease in FinTech deals and a 5 percent QoQ decline in funding, the early weeks of Q4 signals positive momentum. Notable deals, including Tabby’s $200M Series D, Tamara’s $200M venture debt investment, and Halan’s $130M fundraiser, indicate a potential rebound.

Philip Bahoshy, CEO at MAGNiTT, feels that deal activity speaks volumes about investor interest in an industry, and capital deployed reveals the size of their bets. He added, “By all indications, FinTech has led the way in both metrics for the last two years solidifying its status as the key focus in the region. Despite a broader venture slowdown in 2023, FinTech stands resilient, drawing significant attention from both regional and international investors as well as continued focus by regulators including the DIFC, ADGM, the Central Bank, and Sama across the GCC."

Hubertus Thonhauser, Chairman of Ghaf Capital Partners, a digital-asset focused Venture Capital firm based in Dubai, added, “On a quarter-by-quarter basis, after seeing sharp declines in most quarters since the end of 2021, fintech funding finally showed signs of stabilising in Q3’23. But as of Q3/2023 the number of deals and deployed capital are down 40 percent year-on-year, with a decline of 80 deals and $622M in funding compared to 2022 numbers, in line with international trends.”

Thonhauser observed that “Fintech in MENA has to deal with the strong position of incumbent, government backed financial institutions as well as with fragmented markets in a sector that is dependent on volume and scale. Multi-market approaches are therefore key, but costly”.

In a positive sign of continued interest in FinTech investments, Series A valuations of FinTech startups in MENA remained robust, down only by 2 percent from their historic highs of 2022, against the backdrop of an average 26 percent decline of Series A investments in the MENA region. Seed valuations, on the other hand, saw a steeper YoY decline of 20 percent on account of a challenging fundraising environment, comparable to the regional trend.

Commenting on this parity, Thonhauser noted that this was a global trend, not related to MENA alone. He noted that MENA also has a structural problem in VC: excluding sovereign wealth funds and quasi-government entities means the number of local players able to fund the larger financing rounds necessary to transform and scale start-ups for regional and global competition is limited. An active, diverse, and vast limited partner pool would be essential to reduce the funding gap.

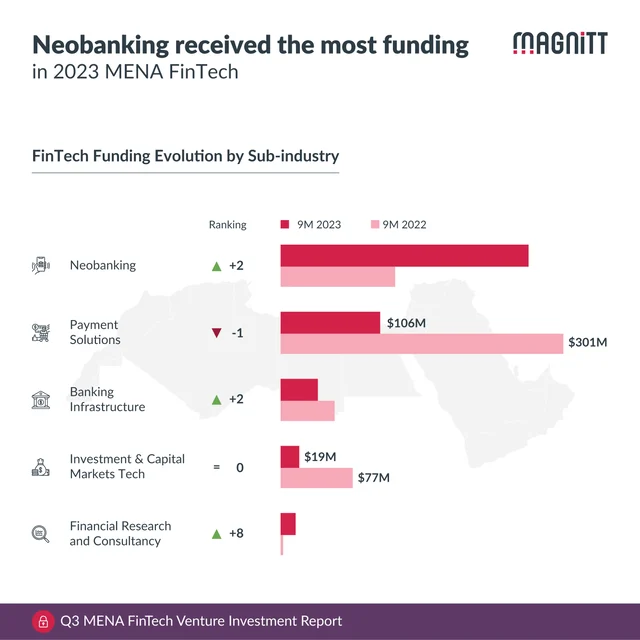

UAE has continued to lead the exit activities in MENA. FinTechs headquartered in the UAE contributed to over 60 percent of all fintech exits closed in MENA since 2019. Among sectors, Payment Solutions reigns at the top by this metric, accounting for 56 percent of all exits recorded in 9M2023. In fact, deep diving into sub-sectors, Payment Solutions also emerged as the leader in transactions, despite a 52 percent YoY decline. Followed closely by the Wealth Management and Lending sectors.

So what areas of Fintech need more attention?

According to Thonhauser, after Payment start-ups dominated the investment appetite in recent past, a more diversified set of start-ups has been funded in the region, including buy-now-pay-later start-ups Tabby and Tamara, open banking companies like Lean Technologies and Tarabut Gateway, lending platforms for SMEs like Lendo and Liwwa, and wealth management players Sarwa and Thndr.

He feels that the future will see the blending of digital assets based on the regulations established by organisations like VARA and ADGM in the UAE, as well as the related Web3.0 industry with the Fintech sector.

“Regulators in the region recognize the potential for fintech to improve financial inclusion and economic growth and are committed to creating a favourable regulatory environment. Apart from ADGM and DIFC in the UAE, recent announcements from Saudi Arabia regarding is open banking framework and Egypt’s digital payment regulation are important steps toward a better regulatory climate,” said Thonhauser.