Mashreq and Emirates NBD launch digital banks for SMEs and startups

A 2018 white paper from the Dubai Chamber of Commerce and Industry reported two-thirds of entrepreneurs citing banking as their first obstacle when setting up their business. The study also said that opening a bank account can take up to three months, making starting the business difficult.

NeoBiz by Mashreq Bank

"Small business owners have long been frustrated by the amount of time, personal involvement and multiple visits that it takes to open an account and conduct transactions. NeoBiz offers a better solution by providing an intuitive, uniform and convenient digital account opening experience, with speed and predictability.”Rohit Garg, Head of Business Banking and NeoBiz at Mashreq

With complete digital transaction capability, a NeoBiz account can be opened online “in just 20 minutes” and offers a choice of three account types: Trader Pro, Basic and Advance. All an entrepreneur needs is a UAE trade licence and less than AED 30M in annual sales turnover.

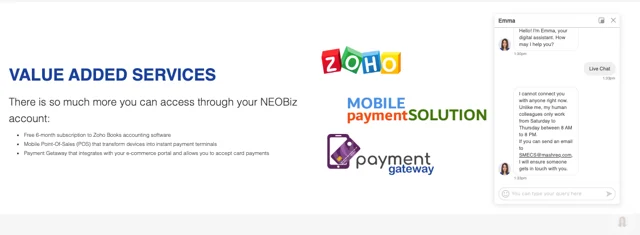

In addition to NeoBiz, Mashreq has introduced two more initiatives for entrepreneurs: A digital chatbox called “Emma” and an online ‘Know-Your-Customer’ (e-KYC) platform.

We reported in August that Mashreq and DIFC had partnered up with norbloc — the Know-Your-Customer platform powered by blockchain — to launch the region’s first production-ready blockchain KYC data sharing consortium.

This is effectively a game changer for entrepreneurs just starting out, as well as startups. It is being introduced with value added services such as Zoho Books, Mobile Point-Of-Sales (POS) system as well as Payment Getaway that integrates with your e-commerce portal.

However, businesses will have to maintain an average minimum monthly balance of AED 50,000, without which they’ll incur a AED 200 fee.

E20. by Emirates NBD

The new bank will have seamless digital account opening which leverages new local advancements such as e-KYC modules as well as the UAE Pass for digital biometric-based identification along with easy, intuitive tools. E20. will help business owners manage their finances and cash flows efficiently and in an affordable manner while also powering their decision-making and growth plans.”Shayne Nelson, Group CEO of Emirates NBD

Currently in the beta stage, Emirates NBD's E20s is being offered by invitation only. The completion of this phase is said to be in the first quarter of 2020.

It is reported to also support entrepreneurs with digital tools that will:

Generate invoices

Track receivables

Give expenses and cash flow insights in P&L statements

Support payments to vendors and suppliers

Deliver information on VAT returns

24/7 live-chat access to a relationship manager

Although some of the features of both banks seem to be similar, Mashreq’s NeoBiz is open completely, while many of the additional features from E20. are being tested and the banking proposition is available only in beta by invitation until Q1 2020. Both local banks are bringing forth banking innovation for startups and SMEs who reflect more than 90% of the UAE businesses, ahead of international banks in the region.